How to algorithmically merchandise your private label products with Miso

When we first launched our suite of merchandising tools in Dojo and via our API, I expected most of the use-cases to be related to things like seasonal promotions, vendor deals, and the occasional need for visual editing. What I was surprised to learn was that a subset of our customers, primarily large marketplaces and retailers, also used Miso’s algorithmic merchandising as a core part of their private-label merchandising strategy.

Admittedly, I hadn’t given much thought to private-labels in a while (ironically, I’m sipping from my “Threshold by Target” coffee mug as I type). The first image in my head were those knockoff cereals I’d see all the time as a kid at the bottom of the shopping aisle, right below the name-brand cereals I actually wanted to the point of the occasional tantrum.

But that was a long time ago. Fortunately, over the past 20 years, the private-label industry has vastly improved in product design, quality, perception, and as a result — market share. Walk down the aisle at Target or Whole Foods, and chances are that a fourth of the products you’re seeing are private-label, stocked side by side on shelves and difficult to differentiate from name-brands.

Given that the breadth, scale, and omnipresence of private label products has exploded, what are the goals a team should have when merchandising them? In this article, I’ll also be discussing use cases of Miso’s merchandising tools that some of our marketplace, grocery and retail partners have utilized to drive conversions of private-label goods and help them compete against name-brands on the national stage. Each strategy can be used in isolation, but it’s far more effective when organizations use several in tandem.

Nowadays, private labels are a huge asset to any retail portfolio. According to a 2022 report by the Private Label Manufacturers Association (PLMA), the private-label industry across all U.S. retail channels is valued at a record $199B (17.7% of the total market)!

Let’s first take a beat though to unpack just all the hype around “private label” products.

It’s common practice for retailers (both online and brick-and-mortar) to design products that are manufactured by a third-party but sold under the guise of the retailer’s own private label (also known as their “store brand”). Typically, these private-label products are lower priced, have little-to-no discernible difference in quality in comparison to their name-brand competitor, and have significantly higher profit margins for the retailer. In other words, private-label products present a win-win opportunity for value-focused customers and retailers alike.

There are other benefits of going ‘private-label’ as well: branding autonomy, insulation from supply chain disruptions, and adaptability to emerging consumer trends. Over time, a private-label brand might even eclipse the name-brand competitor in sales — for example, my family swears by anything with a Kirkland Signature (Costco) label on it. Heck, you could argue that Trader Joe’s is an entirely private label grocery chain. However, there’s a lot to navigate in establishing your private label brand on its brand equity and developing lasting and growing customer loyalty. This is complicated enough in the real world, when it comes to merchandising your private label products in your brick and mortar stores. It only gets more complex online, especially when you’re simultaneously running systems for personalization, semantic search, and revenue optimization.

The tricky tradeoffs of merchandising private label products online

For merchandising at growing online marketplaces, grocery apps,and retailers, we’ve really appreciated that they’re faced with a number of otherwise conflicting goals on merchandising their private label products:

- Increasing brand awareness — Private-label brands are often introducing completely new products to their consumers and are looking to build brand awareness. But they don’t want to do it in a way that makes their name-brand products harder to find or otherwise pollute the normal shopping flow and create friction.

Quick Example: For instance, if your customer types “Duracell” and see your private label options filling the first 5 SERP slots, they’re going to be annoyed. - Avoiding cannibalizing sales — Increasing sales of private-label products (which are generally lower priced) shouldn’t mean that you’re cutting into the sales of brand-name products and it shouldn’t result in a lower AOV and revenue as a whole. Monolithic search and recommendation systems typically lack this type of multi-objective optimization.

Quick Example: If your hypothetical margin on Duracell batteries is 3% but the MSRP is $6 (so a $0.18 is your take), and your margins on your private label brand are 5% but you sell them for $3 (so a $0.15 is your take), you’re losing money by diverting probable Duracell buyers to your private label option. What you really want to do is make sure you’re really driving traffic to your private-label options from customers who are more price-sensitive than brand-sensitive, and would otherwise never buy expensive brand names in the first place. - Recommending good replacements — It can be tricky to know what is actually a good replacement for a brand-name product. This requires a semantic understanding of your product catalog so that the suggested private-label product has a similar feature set.

Quick Example: If you recommend your private label “Lucky Coffee” as an alternative option for Lucky Charms cereal, you’re probably confusing users, and guaranteeing a few over caffeinated six year olds.

How does Miso solve private-label merchandising?

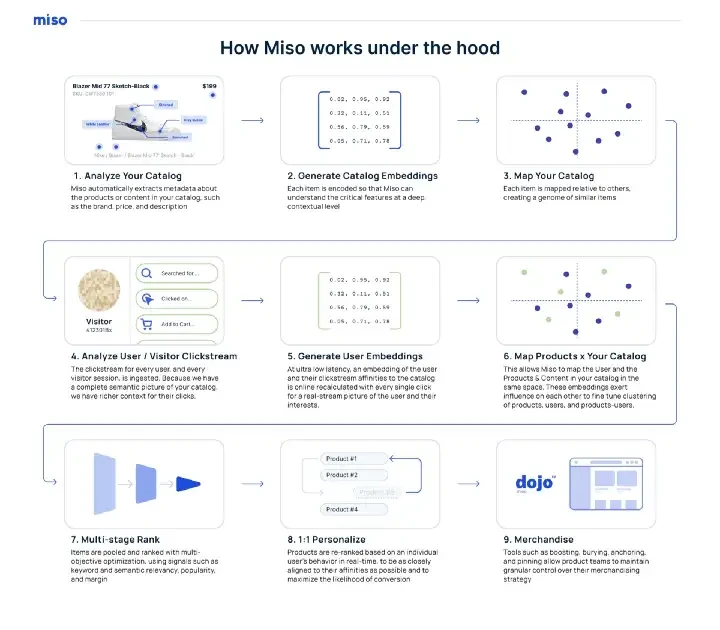

At baseline, Miso performs semantic analysis and multi-objective optimization for maximizing your conversion rate. This allows Miso to suggest private-label replacements that make sense contextually and not look out of place (e.g. suggesting private-label butter, not pasta, when a consumer searches for “Kerrigold”). And while we use personalization relevance as a key signal, it is just one of many (margin, price, popularity, and several more) that we use in our multi-objective optimization to ensure that private-label sales don’t cannibalize your AOV, GMV, and sales of name-brand products.

For private-label merchandising specifically, I’ve outlined concrete approaches below that we’ve used with some of the largest retailers in the world (both programmatically via our APIs and using Dojo, our no-code admin tool) that give your merchandising team full control in executing a private-label merchandising strategy.

Note: Due to our blood oath to partner confidentiality, I can’t disclose the specific retailers that employ these strategies, so I’ll use a fictional retailers and products in my examples.

Let’s dive in!

Strategy 1 — Anchoring

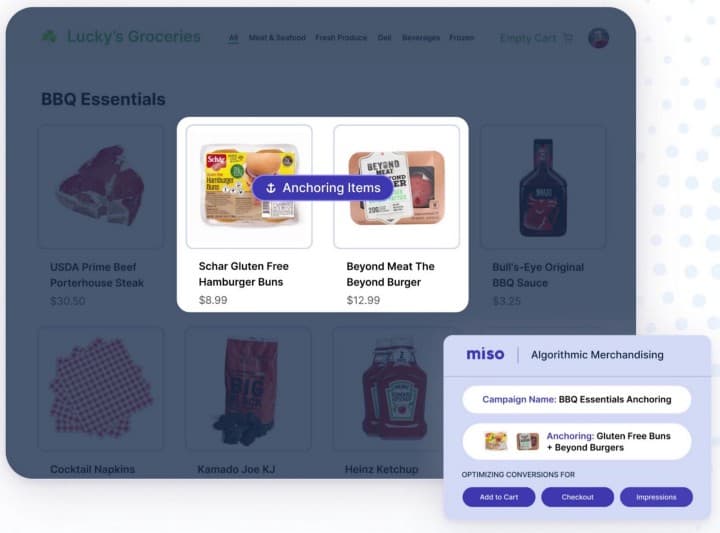

Anchoring involves creating an explicit association between two products: the primary product (the anchor) and a related product that you’d like to promote. Whenever the anchor product appears in search results or within a recommendation feed, the promoted product also appears at a specified location before or after the anchor product. In other words, the promoted products only appear in the results when they’re guaranteed to be relevant to the user.

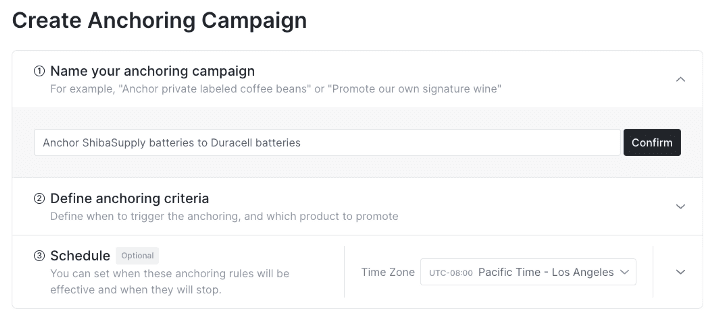

Anchoring is a great method for private-label merchandising. For example, suppose our fictional “everything” retailer, ShibaMart, sells a variety of AA batteries, including brand-names like Duracell and Energizer. ShibaMart also carries its own private-label brand of batteries, “Shiba Supply”, which they would like to promote alongside the name-brand competitors. Using Dojo, our no-code admin dashboard, you can configure a campaign to anchor between a brand-name and private-label product. Here’s what it looks like:

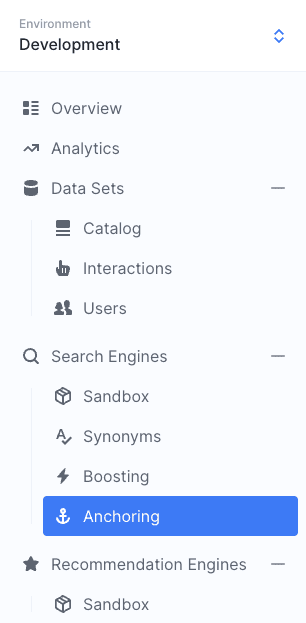

- From the left-hand panel in Dojo, select “Anchoring”

- Click on “+ Create Anchoring Campaign”

- Start creating an anchoring campaign by giving it a descriptive name. Remember, in our example, we’re anchoring our private-label line of batteries, ShibaSupply, to the name-brand Duracell batteries.

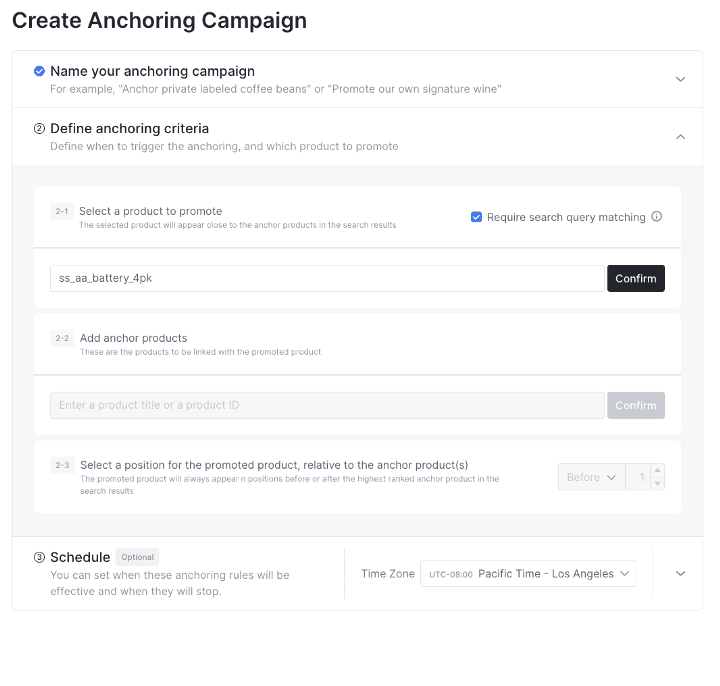

- Next, we’ll choose the private-label product that we want to promote:

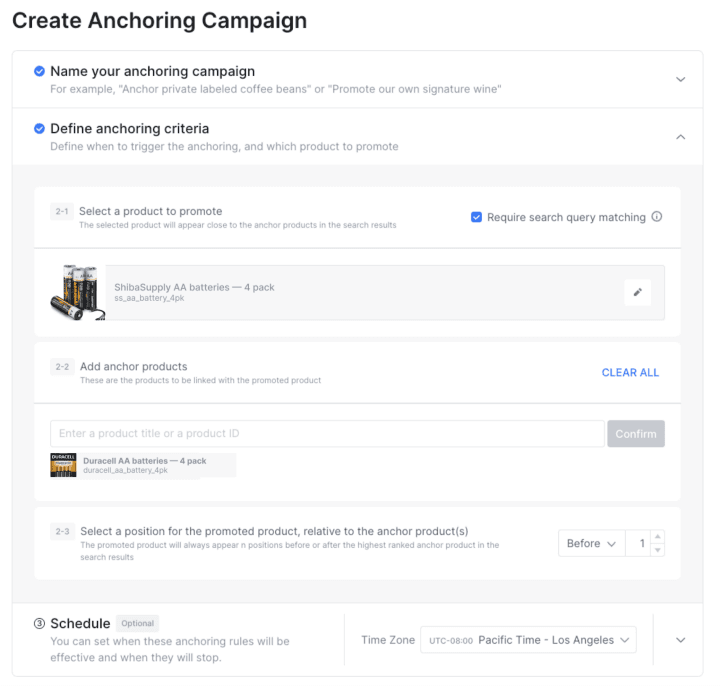

- And let’s choose the name-brand product we’d like to anchor to. In this case, it’s the comparable Duracell AA batteries.

- In the next step, you can choose where the promoted product shows up in search results, relative to the name-brand anchor product. By default, the promoted product will be shown one position ahead of the anchor product.

And that’s it! Now, whenever the product listing for Duracell AA batteries comes up in search results, it’ll be preceded by our private-label product, ShibaSupply.

You can also perform anchoring programmatically, using our APIs. Here’s what the same anchoring campaign looks like using Miso’s Search API:

{

...

"anchoring_settings": [

{

"product_id": "ss_aa_batteries_4pk",

"anchor_ids": [

"duracell_aa_batteries_4pk"

],

"relative_position": -1,

}

]

}

For more on anchoring, check out our Anchoring recipe.

Strategy 2 — Out of Stock Replacements

When a customer adds an item to their cart, there may naturally be some delay until they enter the checkout flow, on the order of minutes, hours, or days. This could be due to a myriad of reasons — they’re still browsing your catalog for additional products, real-life distractions getting in the way, or even waiting until they meet a threshold to enable free shipping.

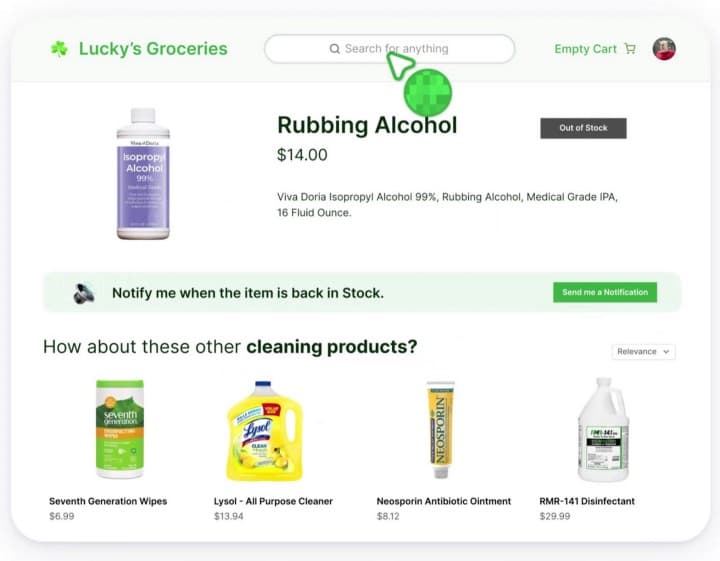

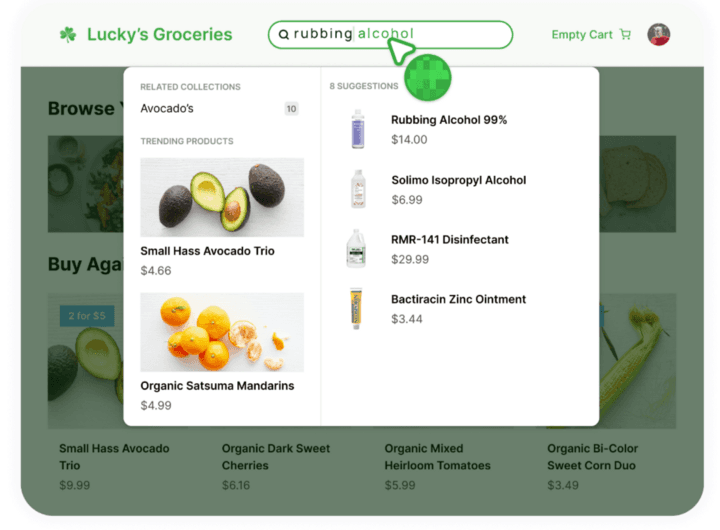

During this time, there may be some fluctuations in inventory level that cause an item in the customer’s cart to become out of stock before they checkout. In these cases, Miso can be set up to suggest similar replacement products. For example, suppose a customer is looking for rubbing alcohol but it’s out of stock. Miso can populate a widget to suggest replacements.

A Miso API call that that generates out of stock replacements (and boost our private-label brand in the process) might look like this:

POST /v1/recommendation/product_to_products

{

"user_id": "user_123",

"product_id": ["rubbing_alcohol_16oz"],

"rows": 4,

"fq": "availability:\"IN_STOCK\""

"boost_fq": "brand:\"Seventh Generation\""

}

In the above example, we’re asking Miso to return four products that are most similar to the out of stock rubbing alcohol, which are also filtered to only include in stock items, and when possible, belonging to a private-label, Seventh Generation. On the front-end, it might look something like this:

Strategy 3 — Semantic Search

Semantic search is a really exciting tool that we’ve developed here at Miso. Its goal is to deeply expand the search results from traditional, monolithic keyword search by understanding the intent and context of a user’s query at a semantic level. So for example, with semantic search, Miso knows the difference between a “shirt dress” and a “dress shirt”. We do this by training our semantic model against a corpus of millions of e-commerce search phrases.

Suppose a user searches for the phrase “rubbing alcohol”. A monolithic search engine might first try to match both terms: “rubbing” and “alcohol”, and if that doesn’t exist, simply try to match on “alcohol”. Of course, there’s a huge difference in intent and context between alcohol, as in “rubbing alcohol” and alcohol, as in liquor. The former is for first-aid, while the latter is for making cocktails. Continuing this example, if rubbing alcohol isn’t available, Miso will recommend other first-aid products, like antiseptic wipes and hand sanitizer.

So how does semantic search apply to private-label merchandising? One of the outputs of our semantic analysis is the ability to parse out brand names. For example, if a user searches for “duracell”, Miso automatically knows that the user is referring to a brand of batteries. The results will then also show comparable private-label batteries. Note that a user searching by a brand-name signals to Miso’s engines that they are likely brand-sensitive (and will update the user embeddings accordingly, in real-time). In this case, Miso will still show Duracell batteries as the top result.

Case Study: Launching Multiple Private-Label Product Lines at Once with Miso

One of our biggest successes with private label algorithmic merchandising was with one of the country’s largest retailers who had just acquired a line of private-label home goods and food products. These products were primarily targeted towards value-oriented consumers, priced much lower than name-brand alternatives.

One of those products was a private-label line of olive oil, which if you’ve ever tried buying in a grocery store, you know can be difficult to choose among the dozens of brands and price points. Here are the goals they shared with us:

- They wanted to increase recognition of these new products to their loyal customers, and most of all increase their private label sales.

- But, in doing so, they didn’t want to cannibalize their brand name sales

- They needed this to be a very easy to manage, no-code setup, since their merchandisers don’t usually write code or get a ton of attention from engineering

- And they wanted to approach this like a product A/B test with lots of engine parameters, boosting settings, price up-ranking, ranking equations that they could apply and fine-tune.

They set up an anchoring campaign using Dojo, Miso’s no-code admin dashboard, so that their private-label olive oil would appear next to the most popular name-brands, whenever a customer searched using certain predefined keywords (similar to how we anchored Duracell batteries to our Shiba Supply counterpart). Their product team ran an A/B experiment once the campaign was live, to full statistical significance, and shared the fantastic news with us: the private-label sales were up over 70%, but it didn’t negatively impact name-brand sales at all. In fact, name-brand sales were also up over 4% during the same period.

Interestingly, they noticed that their private-label olive oil wasn’t really competing for sales against name-brands in the first place. The significant price difference meant that customers were adding the private-label option to their cart when they otherwise would have experienced the sticker shock of the name-brand alternatives and moved on without making a purchase. On the other hand, customers who were already shopping by brand-name were less likely to be swayed by a private-label and were generally amiable with the higher price point.

In other words, using Miso’s anchoring tools, the retailer was able to dramatically increase their brand awareness without sacrificing any name-brand sales.

Deep Thoughts AKA In Conclusion

Private-label products have become an incredibly useful and valuable revenue source for growing brands. But optimizing their rollout amidst your name-brand products and not having them cannibalize each other is very important. We really take this seriously especially because trust in a marketplace is everything, and we always take the viewpoint that private-label is best when it’s serving consumers who view name-brand options as too expensive and out of reach. It’s been very exciting to see that our approach to modeling and ranking personalized experiences for users can be applied to this problem and the programmability for merchandising that we’re opening up.

Before I close out, I just want to give a shout-out to Stian Johannessen, our graphic designer, for helping put the graphics together. And if you found our approach to private-label merchandising exciting and want to know more (or want us to unpack another topic), we’re happy to chat with your team, 1:1. Just send us a note at hello@askmiso.com or get in touch with us via our contact form.